Possibly you need an optional surgery to compliment how you look or develop a facet of how you look that have troubled your, but insurance rates will not defense it.

What exactly are your options? Rescuing right up towards the process usually takes much too long. A loan having elective functions makes it possible for you to get the newest help you you desire nowadays.

Surgery treatment, known as plastic surgery, is very large team about U.S. In the 2021, regardless of the pandemic inquiries, the fresh new interest in face cosmetic plastic surgery ran up by the an impressive 40%, with respect to the Western Academy out-of Facial Plastic material and you will Reconstructive Operations.

And the ones number are not cheaper. This is exactly why the majority of people who need or you desire recommended businesses will either not be able to pay for it.

Reconstructive procedures

Most of the time, reconstructive surgery is about repairing form otherwise looks for somebody who’s sustained a sickness otherwise burns.

For instance, nipple repair operations once a good mastectomy is normal to have cancer of the breast survivors and that is sensed reconstructive. Really insurance firms will cover reconstructive operations included in an excellent larger plan for treatment.

Cosmetic surgery

For example, somebody who cannot such as the shape of its nose gets good rhinoplasty, otherwise nose occupations. Most insurance firms cannot safety recommended cosmetic plastic surgery.

This additional reading can place members of a bona fide bind if they you want surgery treatment but discover that the insurance provider considers it as an elective process of their situation.

For example, anyone who has destroyed significant amounts of pounds could have an excessive amount of surface on the human body that leads so you’re able to difficulty into the wear outfits, chafing the spot where the surface folds scrub together with her and having to bring inside the additional weight your skin increases its complete proportions.

Even though some medical professionals you’ll suggest that the extra epidermis come off, it requires specific really serious persuading from potential health problems from the coming having an insurance coverage company to gain access to one surgery given that necessary or reconstructive rather than recommended.

A belly tuck will cost you up to $six,two hundred, when you’re a transformation will cost you regarding $8,100000. Brand new Western Area of Cosmetic surgeons even offers more info towards the will cost you and more.

Ideas on how to Purchase Cosmetic plastic surgery

There are numerous a beneficial options where you can pay for cosmetic surgery that your insurance carrier wouldn’t defense. For every single has its own benefits and drawbacks. This is what you have to know about each of them.

Consumer loan

Taking right out a personal bank loan can supply you with the bucks you pay having just the brand new procedures but also for specific living expenses although you recover.

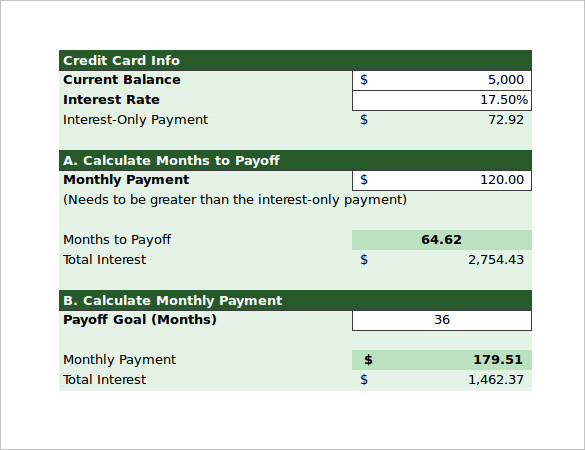

not, if you don’t have an educated credit, you could find that your particular rates of interest to have a personal bank loan you may competition regarding the handmade cards.

Financing in the healthcare provider’s workplace

It might give you the substitute for repay the loan more than the fresh span of a couple of age, nevertheless the rate of interest will be greater than for people who decided to take-out a consumer loan on your own.

Charge card

This permits you to definitely only buy the brand new functions without any worries about carrying a great equilibrium into the doctor’s office.

But not, if your borrowing limit is not high enough you’d chance maxing the actual cards, that will damage your credit score.

Whenever you can find credit cards that gives no desire to possess 18 months, which is a good option – however, keep in mind that they merely will provide you with 18 months to repay the fresh new operations in advance of focus is billed.

Family guarantee loan

With a high closing costs and you will ascending rates of interest, you could finish investing a great deal more than your bargained having to locate a loan.