Relevant Articles

A property collateral personal line of credit was one minute home loan mention based on collateral in your home. These are unavailable from the Government Homes Government, you could receive a beneficial HELOC for those who have a keen FHA mortgage and build adequate guarantee at home so you can be considered. An effective HELOC is actually good rotating personal line of credit to possess home owners to availableness as much as the credit line restriction as required.

FHA Funds

An enthusiastic FHA financing is a wonderful loan choice for very first-day homeowners who don’t possess excellent borrowing, a giant down-payment or fund having closing costs. The brand new U.S. Institution out of Casing and you may Metropolitan Development ensures FHA finance. Eligible homebuyers need certainly to set a down payment out-of simply step three.5 so you can 10 percent towards home. People with credit ratings more than 580 qualify towards step three.5 percent deposit. Consumers having credit ratings ranging from 500 and 580 have to lay out 10 percent.

Even with a ten percent deposit, although not, i don’t have adequate collateral yourself to get to know qualifications criteria for many HELOC loan providers.

Collateral on your own Possessions

Guarantee is the value of your house reduced one financing you are obligated to pay inside. Particularly, a typical the new FHA loan for property costing $250,100 which have 3.5 % off function your first-reputation mortgage an important mortgage is actually $241,250. The original equity is the down-payment out-of $8,750.

If for example the down payment was indeed 10 %, after that your security would-be $twenty five,000. The wonders number having HELOC consideration is at the very least 20 percent collateral, however, essentially loan providers require closer to forty % or higher from inside the security. You’ll be able to your house’s fancy, whenever appraised once more, with your dominating money towards the loan turn you into high equity account at some point.

Trying to get the fresh HELOC

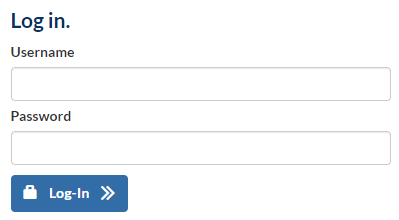

Trying to get good HELOC function being qualified to have a moment financing mention that have a card loan application. Store pricing and you can terms and conditions on finance companies and you will borrowing unions. For individuals who only experienced new FHA financing procedure and you will signed escrow, you’ll have most of the data files you need. Records are 24 months off tax returns, proof of income and confirmation regarding expense. The financial will want their latest pay stubs and you may reasons of any alterations in your situation, if any can be found. The lending company will acquisition a credit history and an assessment for the payday loan Spring Lake the property; the latest assessment try an away-of-pocket charge a fee pay money for.

Financial Factors

Lenders is unwilling to automatically approve HELOCs no matter if there clearly was guarantee. They will consider the high possible percentage of the HELOC, factoring it into your overall obligations-to-income proportion. New DTI looks at monthly financial obligation repayments as compared to monthly earnings; loan providers assume the latest DTI to get forty five % or reduced which have a minimum credit rating out of 660, nevertheless they favor large credit ratings.

Even when there is lots out-of security and you can a decent DTI, loan providers try unwilling to automatically approve HELOCs, specifically for brand new homeowners who don’t provides a lengthy background out of paying off a home loan or paying it off. He is hesitant as HELOCs is 2nd-position fund towards the very first-reputation home loan.

In the a property foreclosure otherwise case of bankruptcy condition, second-position finance receive money that have left finance, if any, after the basic position is paid off. To boost your chance of going one minute-status mortgage, work at your current lender, who keep mortgage cards to the the very first and you may 2nd ranks, bringing additional control more than potential foreclosures payouts.

- U.S. Company out-of Houses and you will Urban Innovation: Help FHA Finance Make it easier to

- Bankrate: The required steps to help you Use From your home Guarantee

Kimberlee Leonard stayed in the latest San francisco bay area when you find yourself probably university at the College from San francisco. Ahead of getting a full-big date author, she worked for big financial institutions such as Wells Fargo and you may State Ranch. She’s establish posts getting names eg Trupanion, Real time Their Aloha, Neil Patel and Home to Wade. She currently resides in their house condition off Hawaii together with her active guy and you may sluggish dog.