A good example

Consumer A need a beneficial cuatro% rate, while you are Client B possess an effective 4.25% rate. Both are buying a beneficial $250,000 family. Consumer A pays $179,674 during the attention whenever you are Client B will pay $192,746. This will be a positive change of $thirteen,072. Then you have to add this attention towards the even more attract Visitors B try paying for the settlement costs on mortgage. Financing the brand new settlement costs causes it to be more difficult so you can qualify for that loan together with high rates of interest can indicate a much bigger monthly payment, which could force your financial budget. In case the borrower certification already are rigid then higher attention rate will be a problem.

Loans to help you Earnings Proportion

Your debt-to-earnings ratio is the portion of your income which is supposed on investing the debt every month. Many lenders like to see a good amount of 43% or smaller. It shape includes what you’re spending on the mortgage, along with college loans, handmade cards, and just about every other expenses you’ve got. While recognizing a higher level to pay for the newest closing costs after that this will increase your payment per month. While you are boosting your monthly payment, you’ve got a high financial obligation responsibility.

Even if you are okay into the more attention and generally are bringing a no closure cost financial, this does not mean you never have money owed within brand new table. Their financial will get enables you to has that loan which takes care of standard closure fees, for example tax recording otherwise escrow. Although not, you may still need to pay having some thing typically energized because the settlement costs, such as for example personal mortgage insurance coverage, import charges, otherwise a property fees.

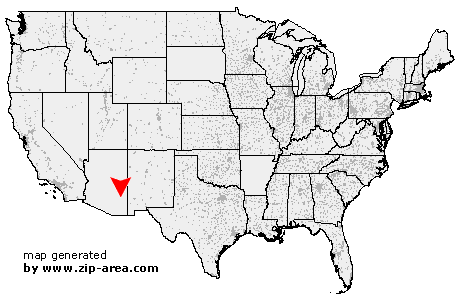

If you are considering a no closure prices home loan then you certainly would be to think through the selection cautiously. You should weigh the benefits loans Lyons CO and you will cons and keep a few things at heart. What’s your inspiration to get the newest zero closure cost loan? How much cash have you been saving by not paying one settlement costs initial? What is the the loan speed and how much does it connect with your monthly installments? Just how long do you really propose to stay in the house?

The selection towards the regardless of if a zero closure rates mortgage is right for you is about to depend on how long you intend toward remaining in our home. If you are planning to stay in your house with the complete home loan name you will end expenses more having the brand new settlement costs, eventually, due to the rate of interest. However, if you are planning on the moving within this a few years of purchasing then the financial effect of your high interest might not number normally. If you have short-term arrangements on the money up coming failing to pay closing costs may be a good means. not, if you feel from the domestic as your permanently home, it’s probably best to spend closing costs upfront, unlike regarding longevity of the loan.

You can utilize more home loan hand calculators to choose in the event that a zero closure rates mortgage is right for you but there are even some other points to consider.

Most people are just eligible for a loan if they can commit to provides a quantity for a down-payment. It is the bulk of discounts for many people and truth be told there is certainly not adequate to pay money for settlement costs. As opposed to needing to dip to the a crisis money or discounts, a zero closing rates mortgage could be the only way that you could go through on the pick. If this sounds like the truth, you must decide if the expense of these financial is right for you or if you should conserve a lot more before you buy a house.