Searching for property is quite time intensive and you may choosing the correct mortgage is paramount to buying your residence and you will closing promptly.

Finding the best virtual assistant loan rates are going to be easy when you discover your credit rating, how it have a tendency to connect with their costs and how to improve your credit score to possess straight down cost.

Now I am able to talk about minimal credit score having a Virtual assistant mortgage, the many Va financing pricing by credit rating, as well as a number of easy methods to improve your rating and then have accepted to have Virtual assistant home loans.

When you need to skip the attempt cost, view here to check on an educated Va costs with your latest get.

What is A beneficial Va Mortgage?

The newest Virtual assistant Financing belongs to what is actually referred to as GI Expenses out of Rights and provides veterans it is able to buy property without any down-payment expected.

Minimum Credit score To possess Virtual assistant Mortgage

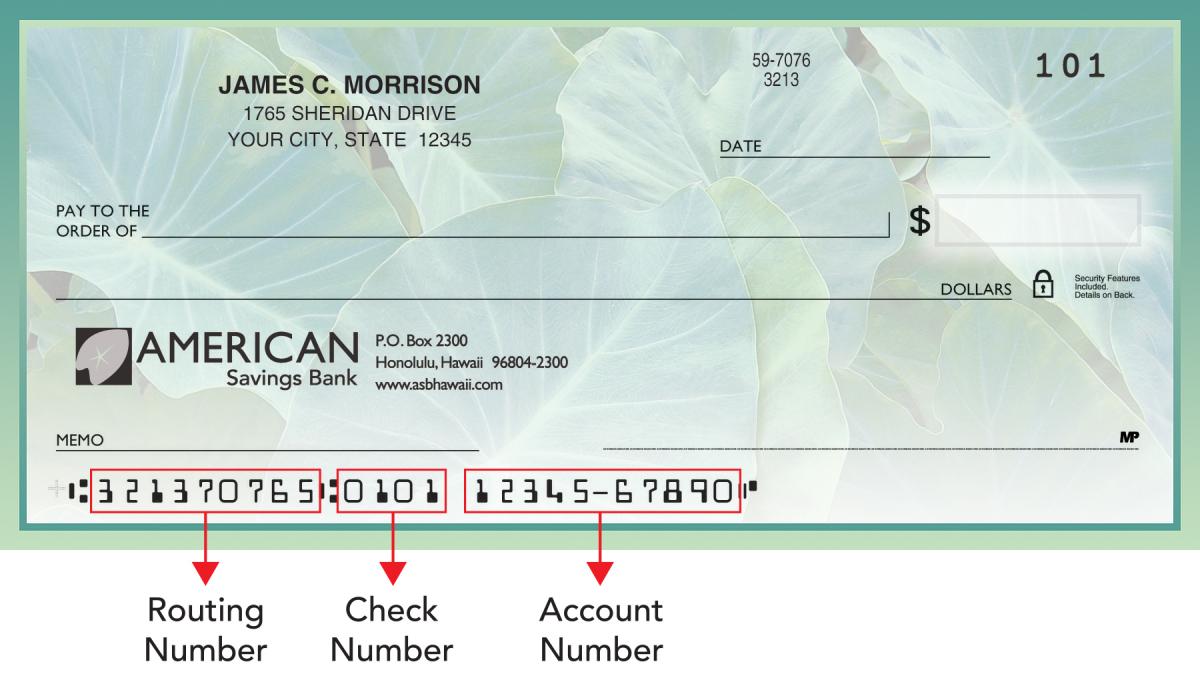

Minimal credit rating to possess a beneficial Va mortgage is about to be available a good 600. In the event that is unusual. Typically you need a great 640 lowest get. You can find out how much from financing you might qualify for because of the checking out Virtual assistant Loan calculator.

Occasionally, a 600 credit history can get you an excellent Virtual assistant mortgage; yet not, it will count on several issues:

#1 Your debt-To-Money Proportion

The debt-to-money ratio greeting to have good Va loan are 41%, which can be used to know if you can qualify for a great Virtual assistant loan.

Which ratio are computed by deciding the fresh new percentage of the gross month-to-month money you to would go to your own regular monthly obligations money.

Say you have a month-to-month earnings off $6,100 as well as your monthly loans money total up to $2,100000. In this case, you have got a debt-to-money proportion off 33%.

In this situation, even though you features a reduced credit history including 600, you happen to be capable be eligible for an effective Va loan due for the reasonable loans-to-earnings ratio, in the event usually you want at the least an excellent 640 get.

Other factors exists such as the amount of lines of credit your features unlock, your down-payment, and you will work record, therefore it is better to explore our very own speed examiner less than for a precise rate.

#2 Your Credit Reputation

There is more than one cause you will get good 600 credit history. A Va bank are looking at the following:

In such a case, an effective Va lender would like to view you keeps during the least 3 trade lines in your borrowing just before several commonly approve your for a financial loan.

This shows that money could be offered slim that will improve lender think you may not be able to spend from the loan.

If this sounds like the case, please score a totally free offer less than, and we will reach out to you telling you when you are ready to apply now or if perhaps tips need earliest end up being drawn with your borrowing.

#step three A job Record

This does not mean you cannot become approved for a financial loan in the event the you don’t need to 24 months out-of a career, it would-be much harder.

Getting a handle with the above around three things is very important getting that be capable of getting accepted to possess an excellent Va financing.

Greatest Va Financing Rates to possess 600 personal loan interest rates 620 Credit history

Such as for instance, a get of 600-620 usually qualify for a similar price, however, a rating from 621 to help you 640 commonly place you in the a lower life expectancy interest.

That have a credit history between 600 to help you 620 you will likely have the second highest interest rate for the Va recognized mortgage.

Because your rate of interest is large, the loan could be high to the thirty days so you can day foundation and therefore make a difference the debt in order to earnings proportion when it is always estimate their qualification.

Predicated on financing administrator William Caballero, The fresh new Va constraints the amount of disregard products one can possibly buy on the a Virtual assistant financing. In most cases the capital actually really worth the savings.

As this is your situation, you really would want to purchase getting your credit score higher and not value paying any situations toward loan.

Your earnings and you may work are going to be important factors since the a decreased credit score is seen as a poor in the attention of any financial.

Note: Whether your score try lower as you don’t have any borrowing, you continue to keep an eye out at the same interest levels.

Zero Borrowing is still managed including Bad credit in a number of implies so make sure you has or add at the least step 3 change traces toward borrowing from the bank as soon as possible.

With this processes, you should be in a position to guide you toward Virtual assistant Financing you to best fits the needs of you and your folks.

Va Mortgage Credit score Price Graph

You want to give you an idea of just how much you could well be protecting for people who simply enhanced your score by the you to class.

If you were to take your score throughout the lower 600’s to help you an excellent 620, you’d be saving an extra $31,348 inside money.