Finding the right coverage to suit your mortgage, mortgage otherwise credit card payments is important. Step one is to know very well what choices are available making sure that you create the first choice which works for you.

Borrowing from the bank money, whether it is a mortgage, loan, credit line, or a charge card shall be rewarding but really challenging. Similarly you have access to the cash you you need as well as on others hands you’ve taken towards obligation out of paying off you to debt. But what manage happens for those who wouldn’t functions? Could you be able to continue and come up with your instalments? One to substitute for believe is actually creditor insurance coverage, which will help create your money after you are unable to. Before you decide to get collector insurance policies, it’s best to understand what its, the way it will help, and if it ties in your finances.

What’s Creditor Insurance rates?

Creditor insurance is built to lessen otherwise repay their financial obligation for individuals who die – or even make your monthly obligations when you are unable to focus because of problems or injury. Specific creditor insurance actually is sold with an advantage for individuals who treat your work. The latest fee made by creditor insurance is known as work with.

Creditor insurance policy is a recommended insurance policies offered by the financial institution or other lenders you borrowed funds from. It is also called home loan insurance coverage, loan insurance rates, bank card harmony shelter insurance rates, or loans insurance coverage.

Term life insurance

Creditor life insurance policies will help to pay-off or reduce the balance your debt for those who die, up to brand new restriction that is manufactured in the insurance coverage deal, called the certification regarding insurance rates. The advantage is repaid myself towards your the harmony which means that your friends does not need to value and then make payments.

Important Infection Insurance coverage

Such creditor insurance coverage might help pay-off or eliminate the brand new a great harmony on your financial or financing when you’re detected with a safeguarded critical problems, particularly certain kinds of strokes, cancer, otherwise heart requirements. The kind of vital disease problems that was covered by your own insurance rates would-be listed in the new certificate off insurance rates. Just like other types of insurance, problems that you’ve got prior to getting the insurance coverage will most likely not feel covered.

Handicap Insurance coverage

Creditor handicap insurance policies may help make costs on your own financial, loan otherwise bank card when you find yourself not able to performs owed so you can illness otherwise injury. It coverage is geared to assist cover the monthly premiums when you’re you are not doing work and you will typically will pay around a certain restrict or time frame. Brand new certificate away from insurance policies will say to you which diseases try eligible for positives, exactly how much the bonus try, and just how enough time advantages would be paid off.

Jobs Loss Exposure

A separate creditor insurance coverage shelter was coverage to have business loss. This provides you with a month-to-month benefit for individuals who reduce your work and commonly generating a living for a particular period of time. Their coverage pays a-flat amount per month as much as a limit which is set-out in your certification out of insurance policies.

How will you Rating Collector Insurance rates?

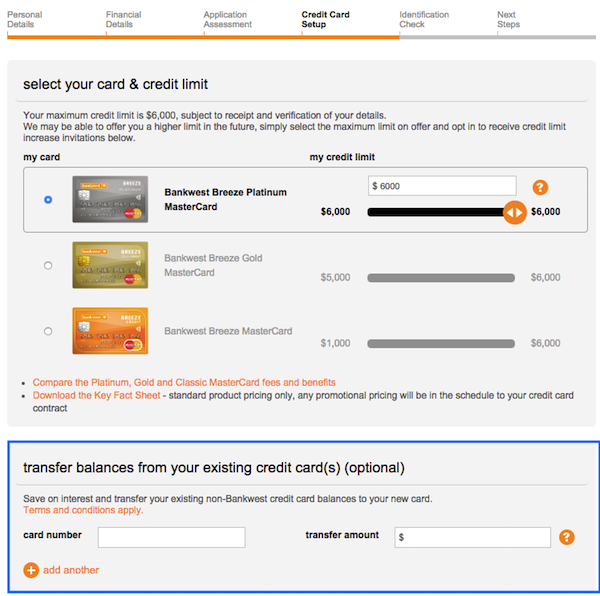

In the event the collector insurance is effectively for you, you might get it right from very banking companies and other loan providers when you sign up for a home loan, loan/line of credit otherwise mastercard. It’s very will it is possible to to try to get it later on 24 hour payday loans Lakewood CO.

The application form might want to know a few wellness issues or if you you will be eligible for publicity rather than answering one fitness issues. For those who alter your mind you is terminate the insurance coverage in the at any time.

Factual statements about Creditor Insurance policies

- It’s easy to apply for.The application often is short to accomplish, and more than individuals is actually accepted once reacting several wellness concerns.

- Capacity for payments. Brand new repayments – named superior – can be put into your mortgage or mortgage money.

- Gurus try repaid toward lender and are usually applied directly to your own the harmony.

- Balance-built superior calculation: the insurance coverage superior towards a credit card or personal line of credit try calculated based on the equilibrium you owe in the a given time. When you yourself have a top equilibrium their advanced might be high than should you have a lowered balance.

For home financing or a predetermined term financing (a loan which have a flat prevent time having repayment), the level of obligations you borrowed continues to ount often age. In fact it is ok since advanced is calculated according to the declining balance therefore the length of time possible are obligated to pay money.

Try Collector Insurance rates Right for Myself?

Every person’s insurance rates need differ, so it is crucial that you consider your insurance coverage within your current monetary package. Like, without having life insurance coverage in place now, collector insurance might possibly be an integral part of making sure you never exit family unit members indebted to repay if you die. In addition, if you actually have insurance, it’s possible to have creditor insurance rates given that yet another defense. Always keep in mind so you’re able to review the insurance coverage need as your existence alter, you try safe in the right way within correct time.

*House and auto insurance items are distributed by RBC Insurance company Ltd. and you may underwritten of the Aviva General Insurance company. In Quebec, RBC Insurance agency Ltd. Is actually inserted while the a compromise insurance agency. Down to government-work on car insurance arrangements, car insurance isnt offered thanks to RBC Insurance rates in Manitoba, Saskatchewan and United kingdom Columbia.

This information is meant while the standard advice merely and that’s not to be relied on once the constituting judge, economic or any other qualified advice. A professional advisor will likely be consulted about your specific disease. Recommendations presented is believed are factual or over-to-day however, we really do not verify its reliability and it also will be never be regarded as an entire studies of your own victims chatted about. All terms away from viewpoint reflect the latest view of your own article writers since of day off book and are generally subject to alter. No endorsement of every businesses otherwise their recommendations, viewpoints, recommendations, goods and services is explicitly offered or designed of the Regal Bank out of Canada or any of its affiliates.