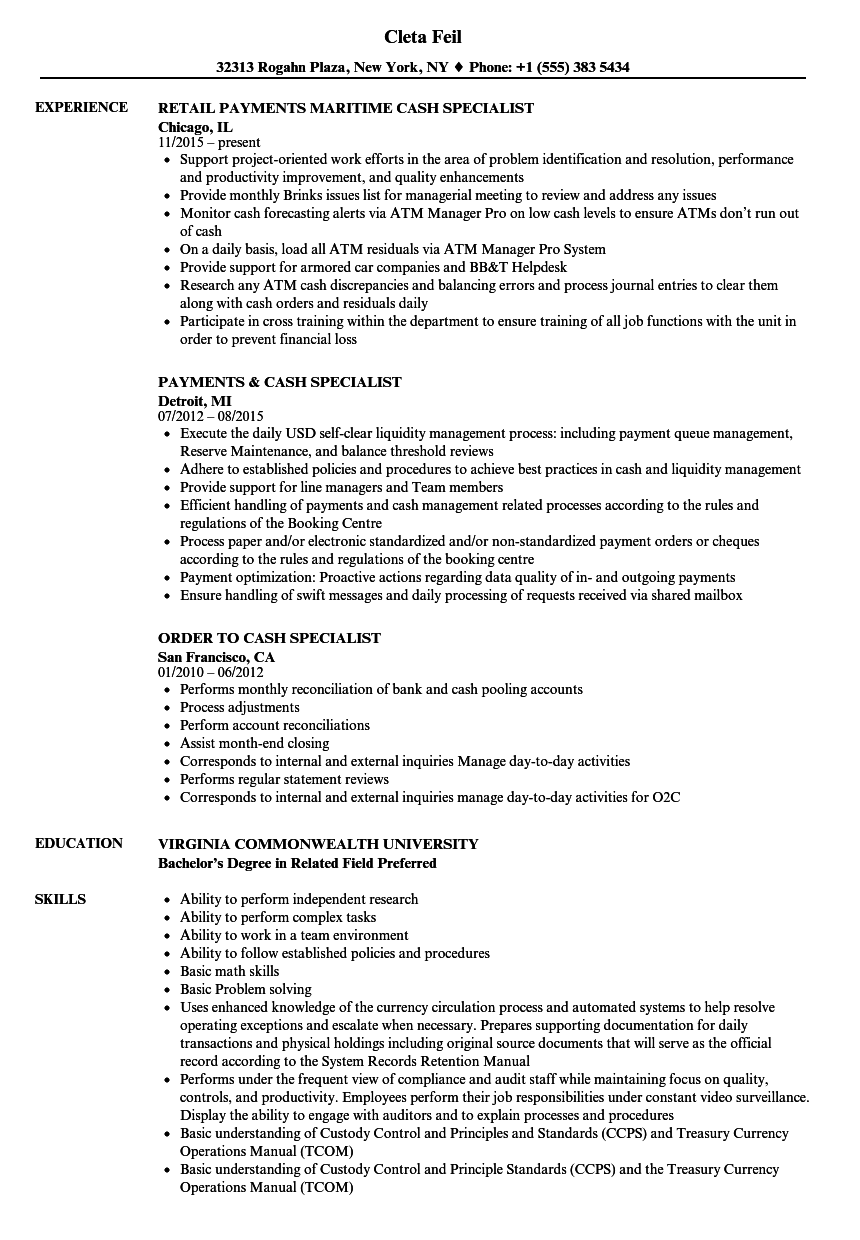

Zero lender tend to accept the Va mortgage request if the financial predicament cannot satisfy all of them. Of several financial institutions commonly charge a fee two years regarding W2s, bank comments, most recent shell out stubs, proof of care about-employment, 1099s, or someone else to test their annual money. They could additionally be trying to find their remaining disgusting monthly money. A remaining gross month-to-month income ‚s the number you really have once and come up with your major monthly debt payments, along with auto repayments and you may home loan repayments.

Financial institutions need certainly to be sure to tends to make your Virtual assistant loan fee having interest rates within a loan term. Thus, it estimate your debt-to-money proportion (DTI).

The level of home loan people are able to afford having a Va domestic financing hinges on particularly activities as his or her money and you can monthly costs. Very Virtual assistant financing was lent if your mortgage payment (in addition to mortgage insurance rates and possessions taxation) cannot surpass 28% of borrower’s gross income. You could potentially obtain a more impressive amount having a reduced rate of interest to possess a Virtual assistant mortgage. Although not, it is very important to adopt simply how much family you can afford. Make up the even more expenses, your own interest rate, and you can a Va financial support commission, and calculate the debt-to-earnings ratio to be sure you could potentially pay off the debt within this an excellent financing identity.

How come a Va Loan Affordability Calculator Performs?

Good Virtual assistant finance calculator is a great unit for deciding how far home you can afford which have an excellent Virtual assistant mortgage. They takes into account pointers just like your money, house price and type, and you http://www.paydayloanalabama.com/providence can borrowing from the bank background and you will venue. A beneficial Va cost calculator works by delivering homebuyers which have an effective specific algorithm one quotes their threat of delivering money based on the lender’s conditions.

Tips Get ready for Purchasing a home having a great Virtual assistant Financing?

Borrowing cash is usually an accountable step, specially when it comes to costly sales, such a house otherwise a vehicle. Hence, it is crucial to set up for the procedure and understand all of the the new measures you’ll simply take. Before applying getting Virtual assistant finance, it is critical to make the pursuing the actions:

Look at the Credit report

Many loan providers may wish to access your own borrowing to make a great mortgage choice. Hence, it’s very important to ensure your declaration does not have any mistakes and you will your credit rating is sufficient to borrow cash towards the advantageous terms and conditions. In the event that a loan provider even offers mortgage that is too much, you have to know enhancing your credit.

Get Assistance from a dependable Mortgage Specialist

Having fun with a great Virtual assistant financial calculator is normally insufficient knowing exactly how much household you really can afford and precisely what the greatest borrowing alternative for you was. As it is vital to use financing as opposed to rather affecting their monthly net income, it can be a choice to talk a trusted financing specialist.

Generate a downpayment

Even when your own Virtual assistant bank tend to instead n’t need a deposit, it may be an effective option. A deposit for your mortgage can be rather lower your Va funding payment, payment per month, and you can interest.

Calculate Your debt-To-Earnings Ratio

Figuring their DTI can help you understand the evaluation involving the loans monthly payment as well as your gross income. This will help to you to definitely dictate the prospective family rate so you can control your mortgage payments having funding costs or other fees.

Would a spending plan

Purchasing a financing percentage, to purchase individual home loan insurance rates, or other effects out-of delivering a beneficial Va home loan can also be somewhat affect the annual money. Hence, it’s very important to choose exactly how much household you really can afford, go with a max family rates, to make your monthly budget dysfunction depending on the loan prices. Always consider carefully your other monthly expenses and money to own unexpected will cost you.